What Makes a Great Real Estate School? Curriculum That Define Success

What Courses Are Available at a Real Estate School? A Total Guide for Aspiring Professionals

Aspiring genuine estate agents have a diverse variety certainly available to enhance their expertise and skills. These offerings range from foundational classes in property concepts to specialized training in locations like residential or commercial property administration and business realty. Comprehending the numerous educational courses can be vital for success. What vital subjects and methods will these programs cover, and how might they shape a representative's career?

Comprehending the Essentials: Real Estate Concepts

The structure of genuine estate understanding exists in comprehending its principles. These concepts include vital concepts that govern the buying, selling, and administration of homes. Trick topics consist of home possession, land usage, and the numerous civil liberties associated with possession. Understanding the distinctions between domestic, business, and industrial buildings is necessary, as each category has one-of-a-kind market characteristics.

Additionally, trainees learn more about market analysis, which includes evaluating building values and fads to make educated choices (Real Estate School). Realty principles also cover the relevance of contracts and the lawful framework that supports property deals. Familiarity with funding alternatives, such as home mortgages and fundings, is important for guiding the economic elements of property. Generally, a solid understanding of these principles furnishes hopeful representatives with the foundational understanding essential to do well in the affordable realty market, leading the way for additional specialized training and licensing

Licensing Requirements and Exam Prep Work

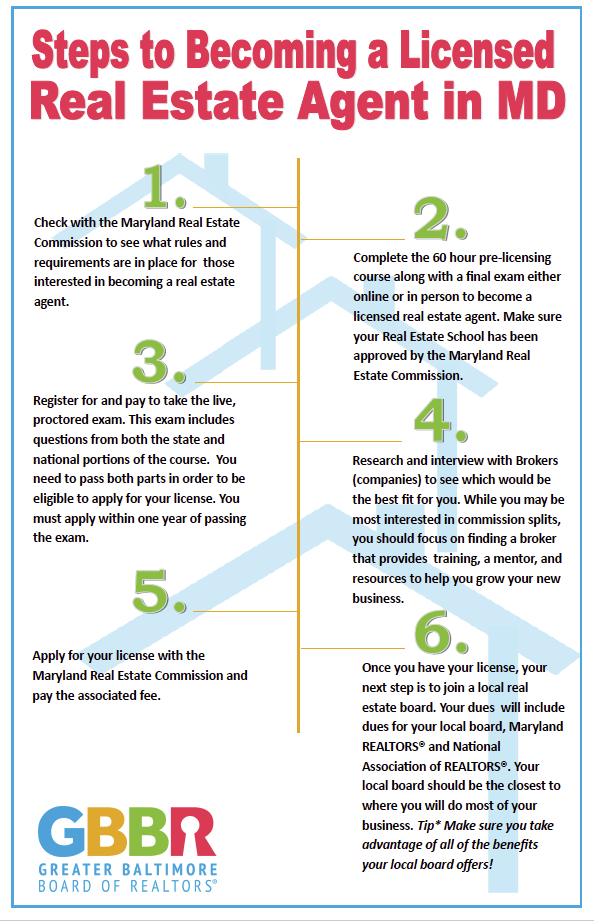

Hopeful property agents have to navigate details licensing requirements to practice legitimately in their particular states. These requirements normally include finishing an assigned number of hours in pre-licensing education, which covers vital subjects such as realty regulation, values, and building monitoring. Prospects must also pass a state evaluation that evaluates their understanding and understanding of these subjects.

Exam prep work is essential for success. Several property colleges provide examination preparation programs that offer method concerns, research overviews, and review sessions. These resources assist candidates familiarize themselves with the examination style and material. Furthermore, joining study hall or utilizing online platforms can boost finding out via collective review and conversation.

When the exam is passed, representatives must obtain their certificate with the state's property compensation, commonly accompanied by history checks and fees. Meeting these licensing requirements ensures that representatives are equipped to offer customers successfully and ethically in the property market.

Specialized Courses: Building Management

Recognizing the intricacies of home management is necessary for real estate experts seeking to improve their know-how in this specialized area. Building administration training courses supply agents with important insights right into the daily operations of managing property and business buildings. These programs normally cover essential subjects such as renter relations, lease contracts, and property maintenance.

Additionally, striving home supervisors discover monetary monitoring, consisting of budgeting and rent out collection strategies, in addition to legal responsibilities associated with renter rights and building guidelines.

Training courses might also check out advertising and marketing approaches for attracting renters and devices for residential property monitoring software program that simplify procedures. By finishing specialized building monitoring programs, realty professionals can much better equip themselves to handle the difficulties of handling properties effectively, eventually leading to improved customer satisfaction and company development. This knowledge is essential for those intending to master the affordable genuine estate market.

Business Genuine Estate: A Different Perspective

Business actual estate operates under special market characteristics that differentiate it from houses. Comprehending investment strategies specific to this field is crucial for success, as is acknowledging the significance of networking chances offered to experts. These elements with each other form an all-inclusive approach to passing through the intricacies of business property.

Special Market Dynamics

Financial Investment Strategies Explained

Various financial investment strategies exist within the domain of commercial property, each customized to meet specific monetary goals and market problems. One usual technique is value-add investing, where investors acquire underperforming homes, enhance their worth with improvements, and subsequently increase rental revenue. One more method is core investing, concentrating on supported, top notch possessions in prime areas that give consistent cash flow. Additionally, opportunistic investing involves higher danger, targeting residential properties requiring substantial redevelopment or in arising markets. Realty investment company (REITs) supply a more passive technique, allowing people to purchase a diversified portfolio of industrial homes. Finally, crowdfunding platforms have arised, enabling little capitalists to engage in larger industrial offers, equalizing access to the commercial actual estate market.

Networking Opportunities Available

In the domain of real estate investing, building a robust expert network can significantly boost chances for success. Networking possibilities are plentiful at realty schools, where hopeful agents can attach with market specialists, instructors, and fellow trainees. Workshops, seminars, and visitor lectures typically include skilled agents and brokers that share understandings and experiences, supplying indispensable contacts. Many colleges additionally assist in regional meetups and networking events, encouraging pupils to involve with the wider property community. In addition, online platforms and discussion forums connected with these programs permit ongoing interaction and partnership. By leveraging these opportunities, students can cultivate relationships that might bring about mentorship, partnerships, and possible task placements, eventually aiding in their expert growth within the affordable business actual estate market.

Realty Financial Investment Strategies

Genuine estate financial investment approaches vary substantially, including strategies such as rental residential property financial investments, turning residences, and involving with Property Investment Company (REITs) Each strategy offers one-of-a-kind chances and threats that investors should carefully think about. Comprehending these choices is essential for any individual looking to construct an effective realty portfolio.

Rental Home Investments

Numerous investors locate rental home investments to be a compelling technique for building wealth and generating great post to read easy earnings. This strategy includes acquiring industrial or household properties to lease to renters, making certain a consistent money circulation. Effective rental property financial investments call for comprehensive market research, assessing home worths, and understanding neighborhood rental demand. Capitalists often gain from tax benefits, such as depreciation and mortgage rate of interest deductions. In addition, building administration abilities are crucial for maintaining occupant relationships and ensuring timely lease collection. Long-term gratitude of property worths can further enhance a capitalist's profile. In general, rental residential property investments can offer a stable income and contribute to financial security, making them an eye-catching choice for lots of in the real estate market.

Flipping Residences Strategies

Turning residences has emerged as a popular method genuine estate investors seeking quick returns on their investments. This technique entails purchasing underestimated buildings, making required remodellings, and selling them at a higher price. Effective residence fins typically conduct detailed marketing research to determine encouraging communities and homes with potential for gratitude. They frequently concentrate on aesthetic upgrades, such as bathroom and kitchen remodels, to boost appeal without spending too much - Real Estate School. Additionally, comprehending funding options and taking care of budget plans are crucial for optimizing profits. Time is essential in this approach, as prolonged restorations can deteriorate revenue margins. Eventually, flipping homes needs a blend of market understanding, improvement skills, and financial acumen to be successful in a competitive genuine estate landscape

REITs and Diversity

Although direct home investment can produce high returns, Property Investment Company (REITs) use a compelling option that allows financiers to diversify their profiles without the complexities of handling physical homes. REITs are business that possess, run, or finance income-producing realty across various fields, consisting of household, business, and industrial buildings. By buying REITs, individuals can get exposure to property markets without the need for substantial capital or direct management responsibilities. This financial investment automobile also supplies liquidity, as shares can be easily gotten and offered on stock market. In addition, REITs usually go to my site pay returns, offering a routine earnings stream. In general, incorporating REITs into a portfolio can improve diversity and alleviate risks connected with conventional residential or commercial property financial investments.

Proceeding Education and Professional Growth

As the realty sector progresses, professionals have to take part in proceeding education and expert development to stay affordable and educated. This continuous discovering is crucial for adjusting to adjustments in laws, innovation, and market fads. Realty schools offer numerous programs made to improve abilities and expertise, including sophisticated arrangement techniques, property administration, and advertising approaches.

Several states require accredited representatives to finish a collection variety of proceeding education hours to maintain their licenses. These training courses usually cover basic subjects such as ethics, fair real estate policies, and risk administration.

Furthermore, sector workshops and workshops give networking chances, enabling representatives to get in touch with peers and market leaders. By joining these academic programs, realty professionals can guarantee they stay skillful and responsive to customer requirements, ultimately leading to job development and success in a dynamic marketplace.

Frequently Asked Inquiries

What Is the Normal Period of Realty Courses?

The regular duration of property training courses differs, normally ranging from a few weeks to a number of months. Aspects affecting this period include program material, shipment technique, and state demands, impacting hopeful agents' academic timelines.

Are Online Courses Available genuine Estate Education And Learning?

Yes, numerous online training courses are available for real estate education and learning. These programs provide adaptability and accessibility, enabling individuals to find out at their very own pace while covering crucial subjects required for obtaining actual estate licenses and understanding.

Just How Much Do Genuine Estate Courses Generally Price?

Property courses commonly range from $200 to $1,500, depending on the organization and training course length. Extra charges for materials, tests, and state licensing might also use, adding to the general expense of education.

Can I Take Property Courses Part-Time?

Yes, individuals can take real estate programs part-time. Lots of educational institutions provide flexible scheduling options, allowing ambitious representatives to balance their researches with other commitments, making it easily accessible for those with active lifestyles.

What Occupations Can I Seek After Finishing Property Courses?

These offerings range from foundational courses in genuine estate concepts to specialized training in areas like property administration and commercial real estate. Actual estate principles also cover the relevance of contracts and the legal structure that supports actual estate deals. While numerous real estate professionals concentrate on domestic markets, the characteristics of business real estate existing special challenges and possibilities that require a various strategy. Real estate investment strategies vary significantly, encompassing strategies such as rental residential or commercial property investments, flipping homes, and engaging with Real Estate Financial Investment Counts On (REITs) Straight building investment can produce high returns, Real Estate Investment Trusts (REITs) supply an engaging option that permits investors to expand their profiles without the intricacies of handling physical homes.